CorVel’s CareMC Edge® is a collaborative claims management platform that vastly improves how claims information is gathered and put to use, speeding up decision-making and care delivery.

Imagine you’re sitting at home on a Friday afternoon, unable to work because you hurt yourself badly on the job several days earlier. You reported the injury immediately but have yet to hear from an insurance claims adjuster or case manager. As a result, you haven’t scheduled any follow-up care, your pain seems to be worsening, and you have a dozen questions about how soon you might recover and who will pay the bills until you return to work. How long would you wait before calling an attorney to advocate for you?

Unfortunately, this scenario is all too common within the traditional workers’ compensation system, where many factors can combine to cause delays in care and communication.

“The claims process is traditionally very siloed with information and data coming from various sources and providers. The claims professional depends on all these sources to set up the claim prior to making contact with the injured worker. This delays immediate intervention and takes time away from more meaningful tasks, like talking with an injured worker or strategizing with care providers,” said Michael Jamason, Vice President of Business Operations, CorVel.

“Adjusters’ workloads also often prevent them from communicating with an injured worker as early and often as they might like. They simply cannot look at every claim every day,” Jamason added. To manage their caseload, many adjusters work on a 30- to 60-day diary, meaning they are only looking at any given claim once every 30 days at best.

Disjointed data is another hurdle. Adjusters can’t take action on a claim without information from all parties involved, which could include Advocacy 24/7, radiology, the treating clinician, utilization review, bill review, the PBM, the employer and the claimants themselves, among others. The problem, however, is that this information is not received in real time.

As a result, “adjusters are constantly reacting to historical information, rather than using current data to make strategic, proactive decisions about the direction of a claim,” Jamason said.

These inefficient communication and workflow processes have implications for both cost and quality of care. Anything that slows improvement in the patient’s condition extends the life of a claim and significantly increases costs.

Addressing these pain points in the traditional workers’ comp process requires a better way to collect, integrate and communicate data so all parties can move forward together.

Three Ways CorVel Improves Processes and Outcomes

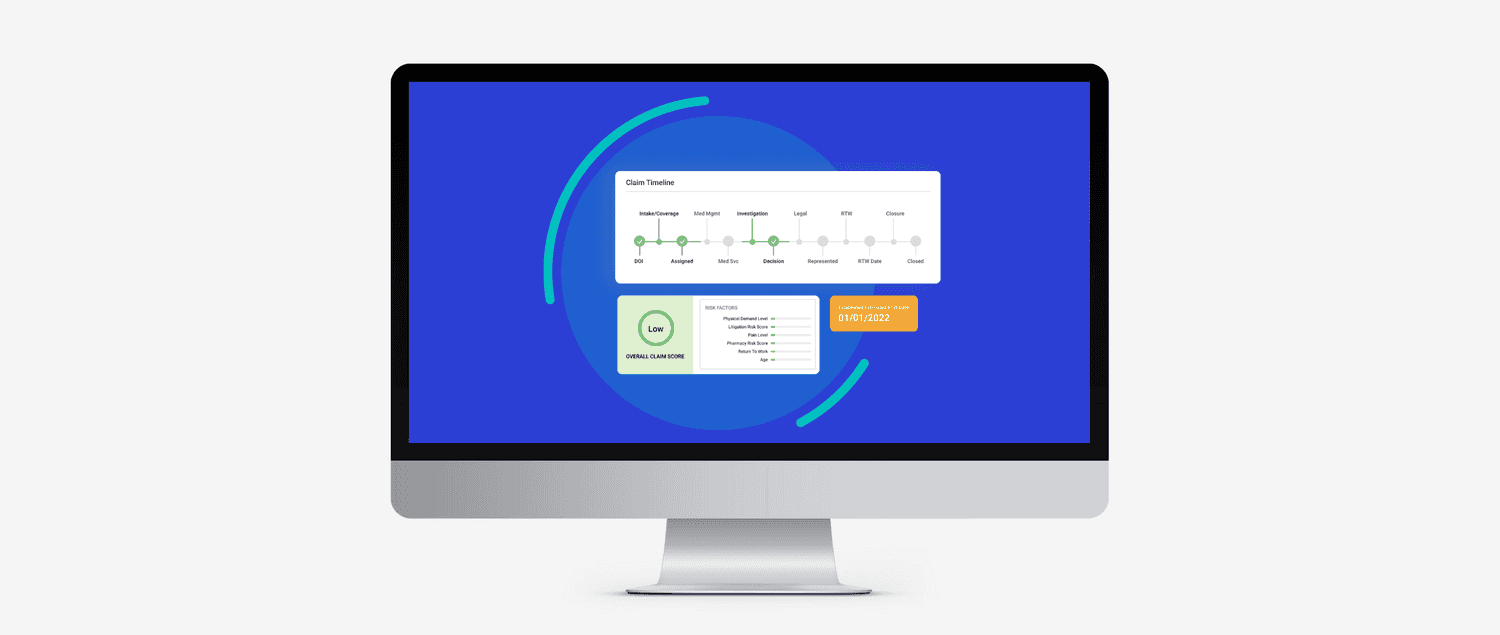

Nearly three years ago, CorVel developed its own technology solution designed to ease the burden on adjusters. Its new web-based claims management platform, CareMC Edge®, allows every stakeholder in a claim to input and access data in real time – no more waiting for paper documents or playing phone tag.

“We thought that there must be a better way to manage claims, so we decided to completely re-engineer the traditional process,” Jamason said.

Rather than position the adjuster as the sole collector of data, CareMC Edge® allows everyone to interact seamlessly and simultaneously. This, in turn, produces cascading benefits for everyone involved — especially the injured worker. Increased efficiency means faster care, less litigation, lower costs, and better clinical outcomes.

CareMC Edge® enables this efficiency through three primary functions:

1. Integration of people and data

Getting the right information to the right people at the right time is critical to speeding up and smoothing out the decision-making process. CareMC Edge® is a central portal that eliminates much of the manual back-and-forth and ensures everyone is on the same page regarding a claim’s status and direction of care.

“It’s about more than the adjuster. Every stakeholder has access to the information and the tools related to their role in a claim,” Jamason commented.

“The critical piece is that the data is accessible in real-time. When everyone is drawing on a consistent set of data, we can work together toward the same goal. We don’t have to work in silos.”

An integrated system for data intake also means that adjusters can act more quickly, breaking the bounds of the traditional 30-day diary. This results in more frequent touchpoints with the injured worker, mitigating the risk of litigation and improving the focus on return to work.

2. Analysis and recommendations

Once the data is in place, embedded standards and algorithms can help adjusters make decisions and prioritize actions. Evidence-based treatment guidelines, disability guidelines, utilization review standards and state laws are all applied to generate an optimized workflow.

“In the traditional process, those standards are out there, but they exist separately. We’re pulling all of them together and building algorithms for every point of the claims process so decisions can be event-driven, not calendar-driven,” Jamason said.

Though final decisions are always in the hands of the adjuster, the platform will recommend next steps and identify high-priority cases. For example, a claimant taking prescriptions with a high morphine equivalency score, or a case for which there is no established return-to-work date, would take precedence.

“Once a decision has been made, the platform will also enable faster execution by automating some of the administrative tasks,” Jamason said. Instead of fighting to pull claims back on track, a set of prioritized, evidence-based recommendations make it possible to keep them from going off the rails in the first place.

3. Visibility and reporting

Integration yields greater transparency into a claim’s progress. Any party can view a claim’s status at any time. This visibility goes a long way in preventing communication breakdowns and frustration.

A central location for data also enables claims executives and risk managers to better spot trends and forecast costs. When data comes in haphazardly, it’s impossible to leverage data analytics effectively. Complete and up-to-date data enables a shift from reactive decision-making to prospective planning. CorVel’s integrated Executive Dashboard is one of the tools that gives visibility into an entire program’s outcomes.

“Better data analysis can help identify common claim drivers, which provides a foundation for proposing a potential solution,” Jamason said.

Supervisor dashboards also include tracking and reporting functions. Claims executives and risk managers know the importance of measuring and demonstrating results. These functions can show whether a new initiative is making an impact on claim trends.

A Better Way to Manage Workers’ Comp Claims

Streamlined cooperation, faster decision-making, and better data analysis all drive improved outcomes from both clinical and cost perspectives.

“Closing the gaps that cause delays will reduce litigation and the length of a claim while also improving the effectiveness of care,” Jamason said. “If we get the right information to key decision makers at the right time, we achieve a more positive experience for the injured worker, while lowering the costs and increasing productivity for employers.”

In addition to better outcomes, CareMC Edge® is also helping to reshape the public image of a career in claims management. Younger workers are looking for effective ways to use technology and want solutions that let them focus on core tasks that make a difference while letting automation and algorithms take care of the “busy work.”

“CorVel’s platform is intuitive and has an attractive user interface. It wraps customers’ RMS platforms seamlessly through API integration and it’s helping to attract the next generation of claims staff,” Jamason added.

“CorVel is 100 percent behind what CareMC Edge® can do and the message it creates.,” Jamason concluded. “We offer this to the carrier market for their claims staff as well as a tool for our own adjusters. Ultimately, we’re creating a better experience for adjusters and injured workers through every step of the claim.”

Learn more about our CareMC Edge® platform here.

Ready to get started?

Our team is ready to answer any questions and help you find the right solutions.